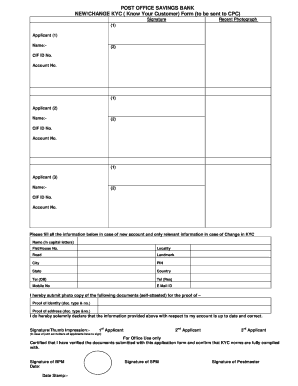

How to Open Account in Post Office Savings Bank

Who Needs Account Opening Application Form?

In India you can open post office savings account and use it as a regular banking account together with other banking facilities. The only thing you need to get started is to fill out special application form. This form is designed mainly for individuals. However, an individual can also open savings account for the minor aged 10 years old or for a person with disabilities. Senior citizens fill out different form.

What is Account Opening Application Form for?

With this application form an individual gets post office savings account alongside other banking benefits like account portability, joint accounts, tax exemptions, interest for the deposit, etc. In this way it is easier for post office account holder to manage their money and grow their earnings. Since many nationalized and private banks in India charge fees and add limitations, it is much more convenient for Indian citizens to hold a post office banking account.

Is Account Opening Application Form Accompanied by Other Forms?

Post office account opening requires some additional documents. They include proof of your current address such as passport, salary slip or even a bill for electricity. Also, an applicant must attach ID proof. It may be driving license or passport. Don’t forget to add two recent passport size photographs.

When is Account Opening Application Form due?

There is no specific deadline for this application. Fill it out when you’d like to open post office savings account.

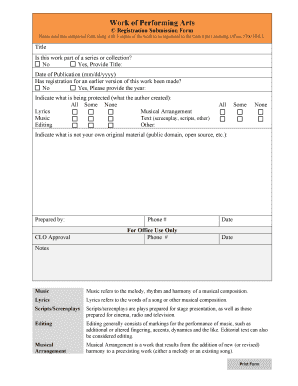

How Do I Fill out Account Opening Application Form?

Filling application form won’t take you much time. The form consists of one page which is split into 18 fillable fields. An applicant is supposed to provide their full name, address date of birth, deposit details, etc.

Where Do I Send Account Opening Application Form?

Sign the form, put a date and send the form to the relevant Post office.