Post Office Savings Bank Account OpeningPurchase free printable template

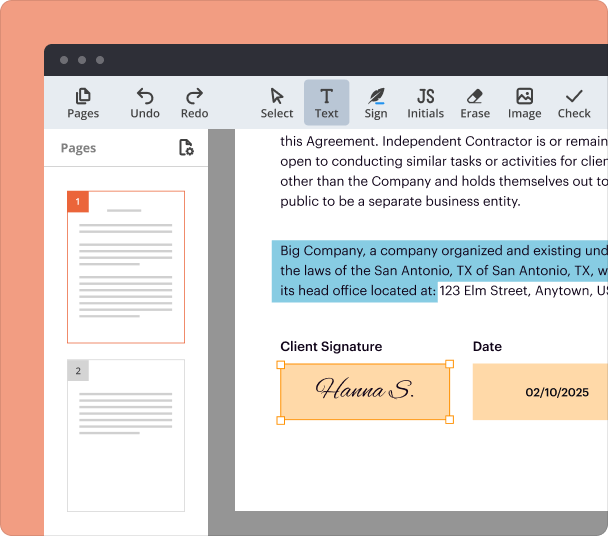

Fill out, sign, and share forms from a single PDF platform

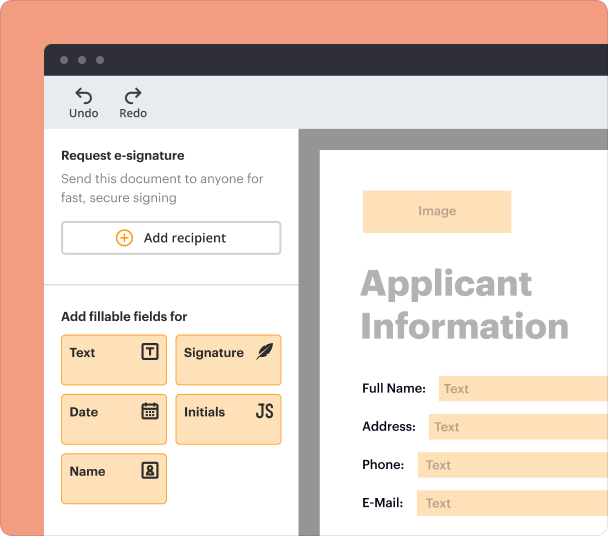

Edit and sign in one place

Create professional forms

Simplify data collection

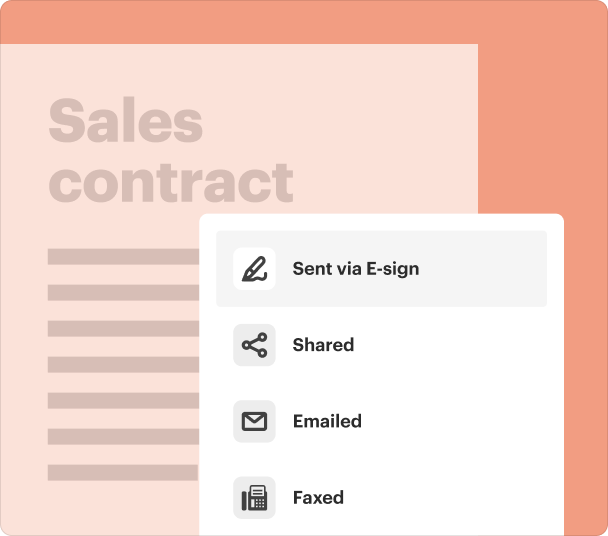

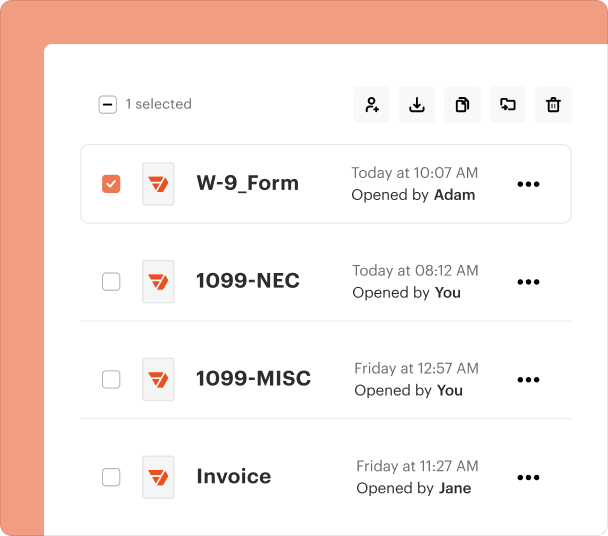

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

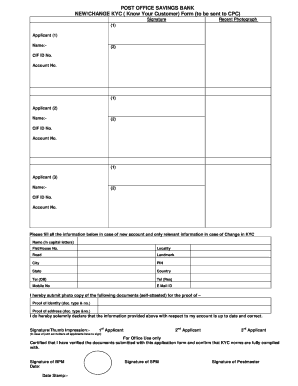

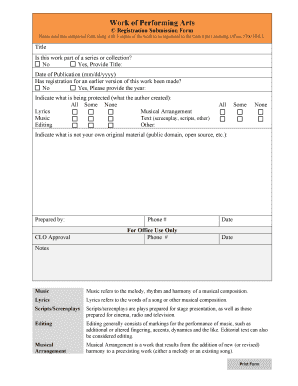

Understanding the Post Office Savings Bank Form

What is the post office savings bank form?

The post office savings bank form is an official document used by individuals in the United States to open a savings account or invest in various savings schemes offered by the postal service. The form collects personal information, details about the desired account type, and any relevant documentation needed to establish the account.

Key features of the post office savings bank form

This form includes sections that capture essential details about the applicant. Key features typically cover the applicant's full name, residential address, contact information, date of birth, and a selection of the account type they wish to open. Additionally, the form may require details on the first deposit and beneficiary nominations.

Required documents and information

Applicants need to provide several documents to accompany the savings bank form. Common requirements include a government-issued photo ID, proof of address, and any necessary identification numbers such as Social Security or Tax Identification Numbers. Ensuring the correct documents are submitted will facilitate a smoother application process.

How to fill the post office savings bank form

Filling out the form accurately is important to avoid processing delays. Start by entering your personal information in capital letters. Provide the exact name, address, and contact information as they appear on your identification documents. Make sure to choose the correct account type and complete sections related to nominee details if applicable.

Best practices for accurate completion

To ensure accurate completion, take your time to read each section carefully before filling out the form. Use a black or blue pen for legibility and avoid any corrections or overwriting. Double-check all entries for clarity, especially numerical information and names, to minimize errors that could lead to processing issues.

Common errors and troubleshooting

Some common errors when filling out the form include illegible handwriting, missing signatures, and incomplete sections. Applicants might also forget to attach necessary documents. If you encounter issues during the submission process, verify all entries against the requirements, and consult the postal service for guidance on corrections or additional steps.

Frequently Asked Questions about post office account opening form

What types of accounts can be opened using the post office savings bank form?

The post office savings bank form allows applicants to open various types of accounts, including savings accounts, recurring deposit accounts, fixed deposits, and different savings schemes offered by the postal service.

Is it necessary to have a nominee for the post office savings bank account?

While it is not mandatory to designate a nominee when opening a post office savings bank account, it is highly recommended to ensure that your funds are properly allocated in the event of unforeseen circumstances.

pdfFiller scores top ratings on review platforms